Apex Trader Funding

Your Ultimate Solution for Getting Funded as a Trader

Don't risk your cash risk ours find out more by clicking below.

NinjaTrader 8, Tradovate and Trading View Trade Copier V10

Copy To multiple accounts entries, exits, stops and adjustments as well as do crossover between mini to micro (micro to mini not recommended).

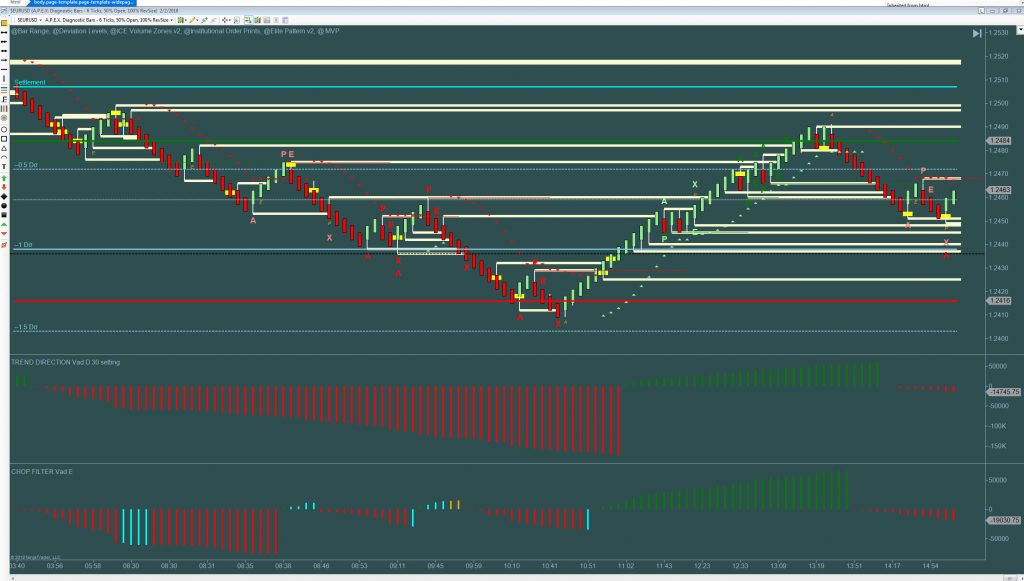

Ultimate Market Reading Tool

A Simple Tool For Reading and Hearing Market Order Flow

Apex Chart Trader

Simplify Your Entries

Apex Automation Trade Assistant

Combine Automation With Analysis

Trading Psychology

Mind Mastery

Master the hardest part of trading with this full course on Trading Psychology

Integrations Mastery Course

Master Putting The Pieces Together

Futures, Forex, Spreads, Touch Brackets, Micro's & Minis, Psychology, Money Management & Trade Systems

Master The Ultimate Hedge Strategy and Get Stops For Pennies on The Dollar!

The ULTIMATE NADEX Breakout Trading System Mastery Course

AND

Master Market Breakouts and Binary Options

Apex All In

Market Mastery and Mind Mastery

Get The Edge You Need!

Click The Computer Below To Find Out More

Apex Is Built Upon 3 Pillars

We have learned as a community that one must not only have knowledge but organized knowledge, have daily interaction as one must not only seek help but must consistently help others to truly excel, and one must have more than freemium tools to give us an edge, we must have cutting edge tools.

Apex Sniper Trading

Learn Techniques And Strategies behind Apex Sniper Trading Systems To Take Your Trading To The Next Level!

Apex Live!

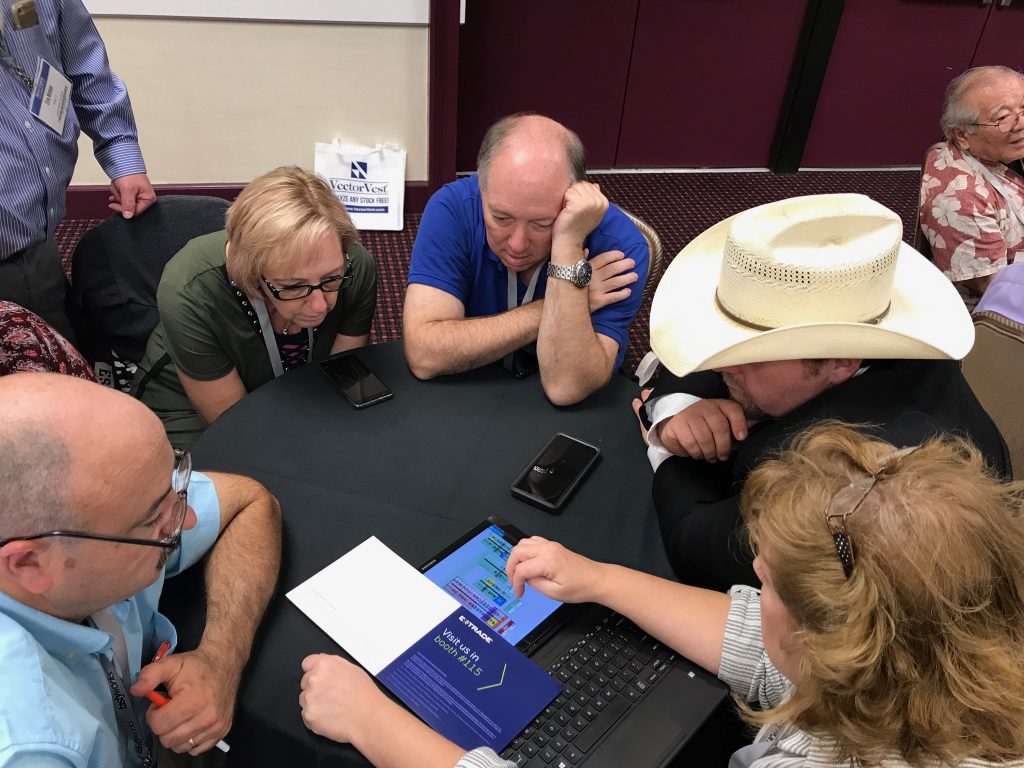

Master Trading Seminars

Reserve your spot at the next Apex LIve! Master Trading Seminar Today by clicking HERE now!

Join us on the Next Education Webinar Free!

Gain access to free weekly live webinars in the free members area by signing up today! Click HERE

See Traders Posting Recent Trades From Apex Systems!

See traders posting on a DAILY basis using Apex Education, Community and Tools See there comments HERE

1

step by step trading Education

Apex Investing has new traders just beginning their journey to retired floor trades. The education has been built for every level of trader to be able to learn and grow. Traders have access to step by step courses, dynamic Q&A through the forum, live rooms, live webinars, and Apex Live! Master Trading Seminars.

2

real dynamic trading Community

Apex Investing is a community of over 26,000 traders. Made by traders, for traders. Traders who are truly engaged, take part in the community and get the most out of it.

Apex Investing offers Traders:

- The ability to engage through a dynamic forum

- Live Webinars

- Live Trading Room - with multiple traders sharing charts

- Small Online Real-Time Mentor Groups

- Apex Live! Master Trading Seminars.

3

cutting edge Trading Tools

The tools at Apex Investing are designed by traders from the total community input of over 26,000 traders. This has resulted in the most cutting edge tools which, are constantly being developed by a team of full time programmers based on request from traders. These tools are made to provide traders a clear edge in the markets and help make trading objective and consistent.

Join over 27,000 Traders in

over 150 countries around the world!

Join The Apex Trading Community Today!

There is no need to trade on an island or float aimlessly. Join experienced Traders who are committed to helping you.

We are Traders committed to helping other traders. We are based out of the United States in Texas.

We teach how to day (and night) trade futures, spot Forex, and options on the North American Derivatives Exchange (NADEX).

Signup Now and Get Immediate Access

No Credit Card is Required, Hundreds of Hours of Videos, Step-by-Step Courses on Futures, Forex and Options, Binaries, Nadex Spreads and Much More. Free Live Weekly Webinars and Access To Multiple Free Tools and The Dynamic Trading Forum.

This is the Final Subheading on the Page

Here, we can ask visitors to connect or share on social media.

Copyright© 2020 Apex Investing Institute All Rights Reserved.

| Disclaimers | Privacy Policy | Help Desk |

Chat Below With A Support Specialist

Phone 1-888-WIN-APEX (888-946-2739)

RISK DISCLOSURE:

Futures and Forex trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing one's financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results.

HYPOTHETICAL PERFORMANCE DISCLOSURE:

Hypothetical performance results have many inherent limitations, some of which are described below. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk of actual trading. For example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses is material points, which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program, which cannot be fully accounted for in the preparation of hypothetical performance results and all of which can adversely affect trading results.

Testimonials appearing on this website may not be representative of other clients or customers and is not a guarantee of future performance or success.

Copyright© 2009- 2020 Apex Investing Institute Members Area. All Rights Reserved.